Prime Minister Justin Trudeau announced Thursday a suite of new measures meant to alleviate some of the affordability pressures people have been experiencing in the post-COVID era — including a two-month GST holiday on some goods and services.

The Liberal government will also send $250 cheques to the 18.7 million people in Canada who worked in 2023 and earned $150,000 or less.

Those cheques, which the government is calling the “Working Canadians Rebate,” will arrive sometime in “early spring 2025,” Trudeau said.

The GST/HST holiday will start on Dec. 14 and run through Feb. 15, 2025.

People will be able to buy the following goods GST-free:

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches.

- Restaurant meals, whether dine-in, takeout or delivery.

- Snacks, including chips, candy and granola bars.

- Beer, wine, cider and pre-mixed alcoholic beverages below 7 per cent alcohol by volume (ABV).

- Children’s clothing and footwear, car seats and diapers.

- Children’s toys, such as board games, dolls and video game consoles.

- Books, print newspapers and puzzles for all ages.

- Christmas trees.

With these exemptions, all food in Canada will be essentially tax-free.

“For two months, Canadians are going to get a real break on everything they do,” Trudeau said at a media event in Newmarket, Ont.

“Our government can’t set prices at the checkout but we can put more money in peoples’ pockets. That’s going to give people the relief they need. People are squeezed and we’re there to help.”

If a family spends about $2,000 on the eligible goods in the two-month period, they can expect to save about $100, according to government figures.

In provinces with the HST — where the GST is harmonized with provincial sales tax — the savings will be larger, the government said.

Provinces with the HST include Ontario, Newfoundland and Labrador, Nova Scotia, New Brunswick and Prince Edward Island.

In Ontario, for example, the same $2,000 basket of eligible purchases will result in estimated savings of $260 over the two-month period, the government said.

The two affordability measures come as the government grapples with persistent unpopularity in the polls and after two stinging defeats in recent byelections.

- What do you think about getting a two-month GST break on certain items? Will it make a difference for you during the holiday season? Send an email to ask@cbc.ca.

The CBC’s Poll Tracker suggests Trudeau’s Liberals are about 17 percentage points back from the first-place Conservatives. That gap has narrowed somewhat in recent weeks.

The renewed focus on the cost of living is designed to bolster the government’s support among people who have been feeling the pinch after prices on almost everything have increased in recent years due to inflation.

But there’s a risk this new stimulus could juice inflation, which has only recently come down to the Bank of Canada’s two per cent target.

Economists agree that unprecedented government stimulus around the world during the pandemic contributed, in part, to elevated inflation as consumers flush with cash chased scarce goods. The Bank of Canada also has said that if Ottawa had pulled back on COVID-related stimulus earlier, inflation likely would not have been as bad as it has been.

Prime Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland announce the government is planning a two-month GST break on some items for the holidays and will send $250 cheques to some Canadians in the spring.

Trudeau claimed Thursday that these measures are “not going to stimulate inflation.”

Finance Minister Chrystia Freeland also downplayed inflation fears, saying the Bank of Canada’s aggressive rate hikes have tamed inflation and Canada is on a more solid footing now.

“We’ve done the hard work we needed to do to get inflation down,” Freeland said.

Asked about the fiscal implications of the multi-billion dollar injection, Trudeau said the government has the capacity to implement these measures “because Canada has one of the strongest balance sheets in the world.”

The federal debt has doubled over the last nine years to $1.4 trillion. The cost to service that debt is projected to be $54.1 billion in 2024-25.

When asked whether it’s appropriate to slash the GST on products that could be considered luxury goods, like pricey video game consoles, Trudeau said most of the government’s affordability measures to this point have been more targeted, like GST rebates for low-income people and an OAS boost for seniors. He argued it’s time to give to everyone some relief.

“It’s time for people to get a bit of a break,” Trudeau said.

NDP to support affordability measures

The measures will be contained in a single bill that the NDP intends to support in the House of Commons, according to a source familiar with the parties’ discussions.

Parliament has been paralyzed for the last six sitting weeks by a standoff over documents related to a failed federal green technology program.

Opposition MPs passed a motion demanding the government release all internal documents related to that scheme and hand them over to the police in an unredacted form. The Liberals have so far refused. Parliament has been deadlocked as a result.

Trudeau said he expects the NDP to come on side with his government to get the parliamentary logjam cleared up and these affordability measures passed.

“The NDP is going to have to step up and get beyond the freeze we’re seeing in Parliament,” Trudeau said.

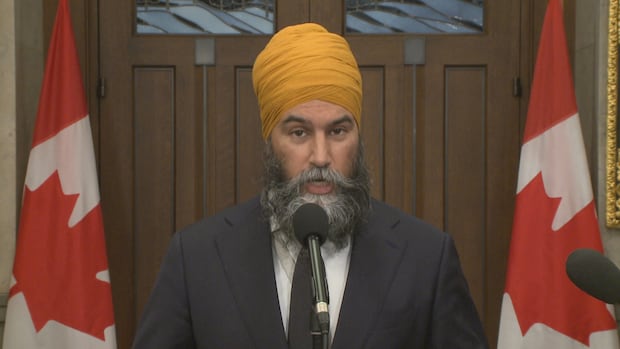

On Wednesday evening, NDP Leader Jagmeet Singh said he would support the government’s GST proposal.

“The NDP will vote for this measure because working people are desperate for relief, and we’re proud we delivered for them again,” he said in a media statement.

Singh is expected to expand further on the NDP’s plans in a news conference on Parliament Hill Thursday afternoon. Conservative Leader Pierre Poilievre will also address reporters Thursday afternoon.

Last week, the NDP promised to go even further to improve Canadians’ purchasing power if elected. Singh said he would permanently eliminate the GST on essentials such as grocery store meals and snacks, internet and cell phone bills, diapers and children’s clothing, and home heating.

NDP Leader Jagmeet Singh says he has written to Canada’s premiers asking them to match his pledge to remove the GST from daily essentials by doing the same with their provincial sales taxes.

This measure would deprive the government of $5 billion in tax revenues each year, the NDP estimates, and would be offset by revenues from a tax on excessive corporate profits.

On Wednesday, Singh wrote to Canada’s premiers asking them to follow suit by removing their provincial sales taxes on essential items.

The NDP will support the temporary measure proposed by the Liberals, even if it is deemed insufficient.

But Singh said Wednesday night the party “will campaign hard on permanently scrapping the GST on daily essentials and monthly bills, like we already promised.”